A collection of tips, videos, articles and guides to help you avoid many scams in the crypto-sphere. Please, watch and read carefully.

How to spot a crypto scam?

Source: The Cryptoverse

Common Crypto Scams

It’s easy to think that everyone is getting rich investing in cryptocurrencies. This mindset leads many traders to fear missing out on the next big altcoin offering or the next leg up in bitcoin. Many scammers take advantage of trader greed with dubious products and services, including the following:

Initial Coin Offerings (ICOs)

These are fundraising mechanisms for newly launched cryptocurrencies. Investors in ICOs receive tokens in the new venture. Investors have poured billions of dollars into more than 1,000 ICOs over the past year. While many ICOs are legitimate, the vast majority have no real business plans or technology behind them. Many get launched with nothing more than a whitepaper by individuals with no technology or industry experience. New altcoins often make unsubstantiated claims about their products. Recently the US Securities and Exchange Commission (SEC) filed fraud charges against two ICOs it says were sold on the basis of fraudulent claims. China has banned the sale of ICOs, and many individuals familiar with fraud, including the famed Wolf of Wall Street, Jordan Belfort, have described ICOs as the biggest scam ever.

Unregulated Brokers & Exchanges

There are dozens, if not hundreds, of unregulated online exchanges and brokerage firms offering cryptocurrencies and cryptocurrency trading products. Investors should be wary of too-good-to-be-true promotions and promises of quick riches. Once you deposit money, many of these firms will charge you outrageous commissions or make it very difficult to withdraw funds. Some of the worst offenders will simply steal your money.

Bitcoin Trading Systems

Bitcoin’s extraordinary volatility has spawned an industry of automated trading systems. The promoters of these products promise traders a way to beat the market by arbitraging prices between different exchanges. Don’t believe the hype. Bitcoin exchanges often have expensive withdrawal processes and hefty fees for trading bitcoin with fiat currencies, such as dollars or euros. Also, settlement of bitcoin trades can take hours. These factors will eliminate any profits from bitcoin arbitrage and may even lead to losses.

How to Safely Trade Cryptocurrencies

Cryptocurrency trading is risky and highly speculative, so there is no low-risk way of investing. However, traders can mitigate some risks by following a few simple rules:

Invest only what you can afford to lose

Cryptocurrencies are far more volatile than stocks and bonds, and the industry evolves rapidly. An altcoin that is popular today may not exist a month or a year from now. In other words, traders should consider the possibility of losing everything when they start trading. For this reason, you should put only a very small portion of your portfolio in this sector.

Research Investment Opportunities Carefully

Investors should read reviews on brokers and exchanges prior to opening accounts. The cryptocurrency industry has news every day on new products and exchanges, so finding good current information is vital. Forums such as CryptoCompare and BitcoinTalk can be a source of information and advice.

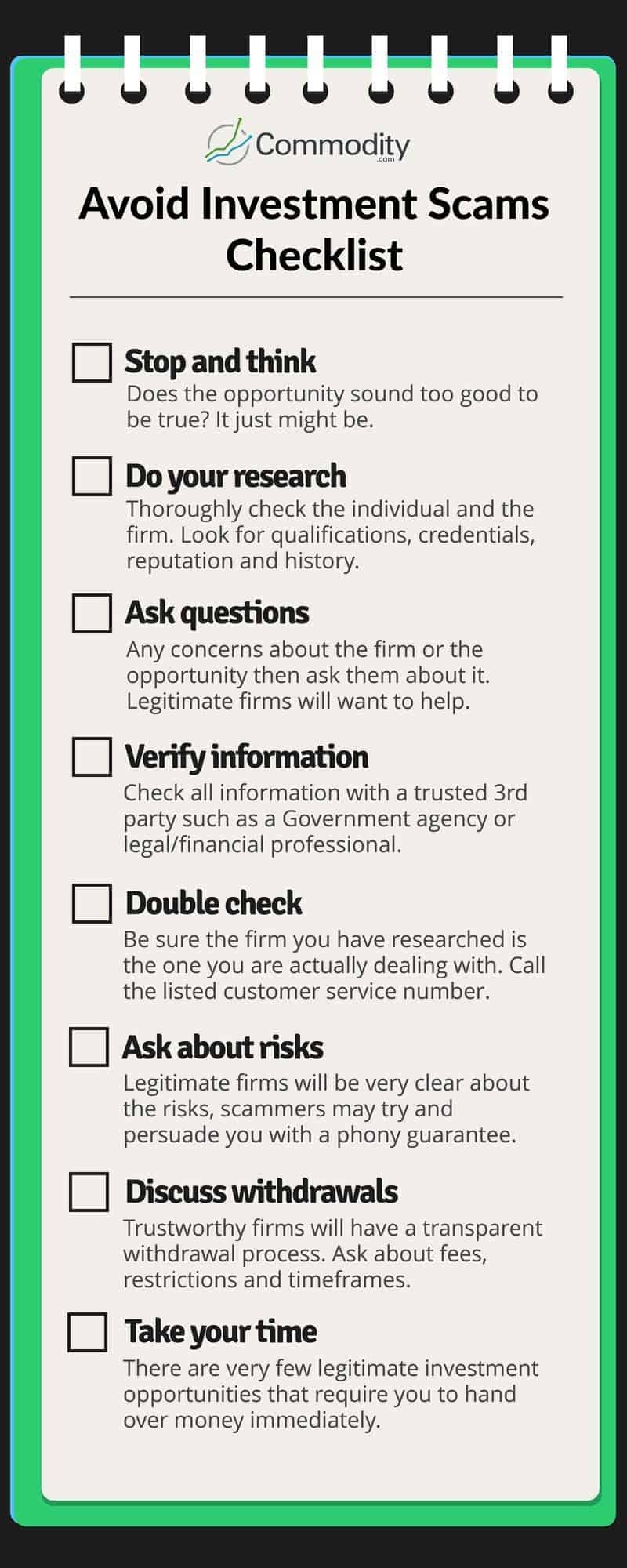

Read more at: https://commodity.com/cryptocurrency/avoid-scams/

Source: Commodity.com

Source: Commodity.com